Another Reform & Another Crisis?

The current financial crisis has spawned new regulations around credit, liquidity and systematic risks. Post Crisis, the regulators and supervisors have a bigger challenge ahead in deciding “What’s next for better tomorrow”?

One of the common platforms where Basel Committee on Banking Supervision (BCBS), International Monetary Fund (IMF), International Accounting Standards Board (IASB) and Financial Accounting Standards Board (FASB) are striving to achieve is in reducing the Pro-Cyclicality in modern banking system and to strengthen the regulatory and supervisory framework. The motivation behind tightening the regulations is due to the existence of systemic risk; where the financial difficulty of one bank has its effect on other.

Changing Banking Regulations:

The best thing about banking regulation is “It’s an on-going process”. Banking Regulations continuously updates, innovates, supervise, regulates and protects from future down turn. The on-going improvement procedures have not been developed upfront but flew through all types of economic shocks since 1930 crisis. Following the panic of “Great Depression’, the Glass-Steagal Act of 1933 bought major steps to regulate and supervise the state banks with deposit insurance. Paul Volcker, the then Federal Reserve chairman set a benchmark in making any speculative investments by the bank. The key step is to protect depositors from risk associated with securities transaction by prohibiting commercial banks from participating in investment banking activities. Hereafter, banking regulations did not undertake any major steps till early 1970’s, when deregulations and relaxation of reserve requirement came into picture. This also led to the rise of Basel Committee for Banking Supervision (BCBS) in 1974.

The global Banking regulation took a major step in strengthening the financial system with a broader vision on improving financial stability.

In 1988, Basel I stipulated the minimum capital to Risk-weighted assets of 8%. Basel I assigned weights to various types of bank loans based on their riskiness. This was then revised in 2004, known as Basel II with enhanced measures of credit risk and detailed specification of the supervisory methods to be used and the disclosure requirements to be met by the banks. Also in September 2008, further enhancement on the requirements on the liquidity management that banks has to adopt by stress testing the cash flow projections.

Volcker Rule: “The most far-reaching overhaul of banking since the Great Depression”- BBC World Service. Early 2010, The President ban on banks trading securities on investing in hedge funds or private equity groups leading to speculations.

Basel II and Recent Financial Crisis:

After reconciling the historical data, case studies and upgrading the Banking supervision, major financial institution found a terrible downfall without proper assessment in risk. Let’s check what Basel II has to respond on the crisis;

- Pillar one, determining the adequacy of capital charge for structured products failed to consider the correlation factor between the assets. – Led to assess pro-cyclicality of assets.

- These structured products tend to react abruptly during changing economic conditions like Volatility, Value-at-risk assessment models etc. – Led to development of Volatility Risk.

- Credit default risk on banks trading books should have higher capital charge as they tend to have low volatility in secondary market.

- Banking Risk Management system should internally enhanced scenarios for Stress-testing framework.

- Average level of capital requirement is in-adequate. This led to increase in capital requirement in Basel III.

- BCBS concluded that capital requirement tend to reinforce due to Business cycle fluctuations.

- Bank has to remove some of the risky financial instruments from its balance sheet.

- Dependency on poorly regulated rating agencies is always a point of conflict.

Birth of Rating Agencies:

The rating agencies are the most powered in the financial system of any country. The dependency between the rating agencies and the Bank’s regulatory system is getting closer in the modern era of banking system. In fact there are number of voices raised against the poorly regulated rating agencies and the usage in the forecasting models in new capital requirement. The rating agencies have been started with the intension of providing the best information or the data related to the company or the financial institutions. But now these agencies have become more dominant in determining the financial status of any country.

Back in the early 19th century, ‘Lewis Tappan’ the founder of Mercantile Agency (Dun & Bradstreet) in 1841 was very successful in finding a gap between the potential investors who were looking for safe investments in a corporation and lack of information or fact sheet of the companies. This was accompanied by ‘Henry Varnum Poor’ (Standard & Poor) who was a profound editor of the information or the fact sheets supporting the statistical models. Later in 1909, ‘John Moody’s innovation was to combine the reports of S&P and D&B with the investor focus.

The advent of usage of Historical data for the future prediction trends was invented by W. Braddock Hickman during the second half of 20th century. His research brought the concepts like Historical financial data, probability of default, credit ratings and exposures. These concepts are retained in the modern banking regulators but with more forward looking approaches.

Any rating agencies on the financial instrument would provide the details like the ‘Probability of default’, ‘Historical data’, ‘Statistical analysis’ which are purely an predictive or forecasting model. The financial market may just look at the output of the agency reports and may over react in valuations. These agencies would never quote about the ‘Systematic risk’ which the regulators are striving to achieve. So the need of these agencies is as usual limited.

Forget the History, what’s now?

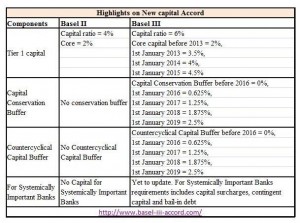

The Basel committee issued Basel III supporting the details of global banking regulations on capital adequacy and liquidity endorsed by G20 nations. The framework sets its aim on higher capital requirement and assessment on liquidity risk promising to reduce banking risk and severity of future crisis.

International Accounting Standards Board (IASB): IASB develop and publish International Financial Reporting Standards with an objective of improving transparency and comparability of financial information across the globe. Some of the improvement zone recommended by Basel II suggests that the reduction in Pro cyclicality can be achieved by adopting more forward looking provisioning, supporting the initiative of IASB to move towards Expected loss approach (EL Approach) from Incurred loss approach. EL approach would predict the future shocks and defaults of financial instruments into current financial statement.

Both Basel Regulations and IASB standards believe that early recognition of loan losses could have significantly reduced the pro cyclicality of current crisis and proposes that the boards should establish a group comprised of investors, regulators, supervisors and auditors to evaluate the technicalities involved for the better banking tomorrow.

Conclusion:

“However good our futures research may be, we shall never be able to escape from the ultimate dilemma that all our knowledge is about the past, and all our decisions are about the future”. –By Ian Wilson, American scenario planning expert and strategy consultant

Bankers and Risk Officer’s play a crucial role in developing an efficient Risk Management Plan. Although the magnitude of the assessment and output of statistical models seems more satisfactory, conveyed, but the adverse result is still “Uncertain”.

The advent of derivatives and other complicated financial instruments has proved impossible to predict the default values of the future and hence the Banking Regulations are prone to change on every dip and rise in the economy.

Some of the queries which are open even after tightening regulations (Including Basel III and IFRS convergence) are:

- Does this new reform prevent another crisis?

- Do our banking regulations force us to go back to our basics of technical analysis?

- Should the entire Banking system return to traditional way of doing Business?

- Are these regulations improving the financial system into more efficient and stable?

- Will these bring down the corporate governance, corruption and poverty?

- What impact does pro-cyclicality have on long term economic growth over an economic cycle?

By: Gokul M Krishnan

**********************************************************************

Hand-phone: +91 99452 50925

URL: http://www.linkedin.com/home?trk=hb_tab_home_top

Email: gokul1948@gmail.com

Gokul is an Associate Consultant for Financial Risk Management and an independent researcher on banking services for loans and structured products.

Gokul has around 2 years of experience in the Risk Management advisory. He is responsible for delivering high quality risk management solutions for Credit and Operational Risk. Before joining Financial Software Solution Services, he was working as Hedge Fund Analyst in Northern Trust, a Global leader in delivering investment management, asset and fund administration for more than 120 years.