The Case for Evaluating Business Credit

By: Sageworks, Inc.,

Executive Summary

Recent challenges in the U.S.have bolstered the need for examining credit risk. This whitepaper will describe what types of businesses should examine credit risk and under what circumstances evaluating the likelihood that a business will default on its financial obligations can boost profits or protect your business. It will provide a brief review of current methods available for businesses to evaluate credit risk and describe some of the advantages and shortcomings of various methods. Finally, this paper includes a directory of online tools to help manage risk tied to credit and business relationships.

Challenges

More than three years after the official end to the recession considered the worst since the Great Depression, U.S.businesses are recovering but not recovered. Privately held companies in the U.S. are generating average annual sales growth of around 6 percent, and profit margins on average are at a five year high.1 The Dow Jones Industrial Average of major publicly traded U.S. companies recently traded at a five-year high, and the U.S. economy continues to post positive – if small – gains.

But uncertainty remains the mood of the day, with surveys showing that a sizable portion of private companies are worried that a potential lack of demand is the top barrier to growth.2 Business owners must protect themselves against financial and operational risks, even as they balance the need to service customers and plan for growth. Obtaining a business credit report can address this challenge.

Bankruptcies & Business Closings

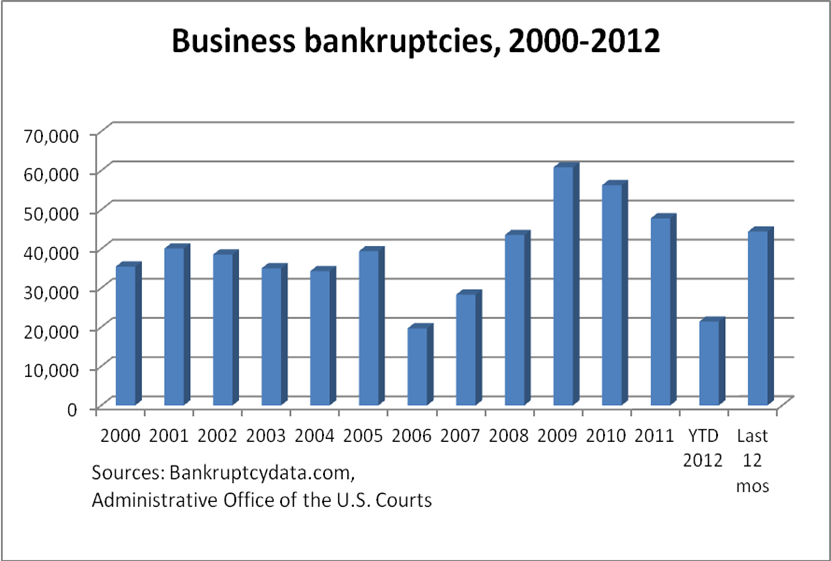

The financial and operational risks to business owners are evident in several statistics. Business bankruptcies peaked at nearly 61,000 in 2009, and they’ve declined to around 47,000 in 2011.3 But the 44,435 business bankruptcies that have been filed in the 12 months ended June 30 remain more than 28 percent higher than the annual average between 2000 and 2006.

And as recently as the first quarter of 2011, business failures outnumbered business startups, according to the Bureau of Labor Statistics.4 These statistics indicate the economy is not back to where it was before the recession, so credit risk remains a concern.

Continue reading here: The Case for Evaluating Business Credit